Financial Applications¶

Exercise 13.1¶

The parametric simplex method should be used when the number of investments to analyze is large.

[1]:

from pymprog import model

def find_optimal_portfolio(R, risk):

mu = max(0, risk)

#monthly returns per dollar for each of the n investments over T months

T, n = R.shape

#R = numpy.cumsum(M, axis=0) / numpy.arange(1, T + 1)[:, None]

#approximate expected return using historical data

#r = R[-1, :]

r = numpy.mean(R, axis=0)

lp = model('Portfolio Selection')

#lp.verbose(True)

x = lp.var('x', n, bounds=(0, None))

y = lp.var('y', T, bounds=(0, None))

lp.maximize(mu * sum(x_j * r_j for x_j, r_j in zip(x, r)) - sum(y) / T)

sum(x) == 1

for t in range(T):

-y[t] <= sum(x[j] * (R[t, j] - r[j]) for j in range(n)) <= y[t]

lp.solve()

#lp.sensitivity()

lp.end()

return numpy.asfarray([x[j].primal for j in range(n)]), lp.vobj()

import matplotlib.pyplot as plt

import numpy

M = numpy.asfarray([[1.000, 1.044, 1.068,1.016],

[1.003, 1.015, 1.051, 1.039],

[1.005, 1.024, 1.062, 0.994],

[1.007, 1.027, 0.980, 0.971],

[1.002, 1.040, 0.991, 1.009],

[1.001, 0.995, 0.969, 1.030]])

risks = numpy.concatenate((numpy.linspace(0, 3, 48),

numpy.linspace(3, 5, 6)[1:]))

X = []

for _ in risks:

_ = find_optimal_portfolio(M, _)

X.append(_[0])

plt.plot(risks, X)

plt.xlabel(r'Risk $\mu$')

plt.ylabel('Fraction of Portfolio')

plt.title(r'Optimal Portfolios')

plt.legend(['SHY', 'XLB', 'XLE', 'XLF'], loc='lower right')

plt.show()

<Figure size 640x480 with 1 Axes>

Exercise 13.2¶

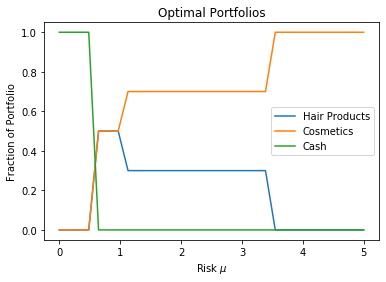

Planet Claire’s efficient frontier is a plot of every portfolio in terms of risk–reward.

[2]:

M = numpy.asfarray([[1, 2, 1],

[2, 2, 1],

[2, 0.5, 1],

[0.5, 2, 1]])

risks = numpy.linspace(0, 5, 32)

X = []

rewards = []

for _ in risks:

_ = find_optimal_portfolio(M, _)

X.append(_[0])

rewards.append(_[1])

plt.plot(risks, X)

plt.xlabel(r'Risk $\mu$')

plt.ylabel('Fraction of Portfolio')

plt.title(r'Optimal Portfolios')

plt.legend(['Hair Products', 'Cosmetics', 'Cash'],

loc='center right')

plt.show()

Exercise 13.3¶

Converting (13.5) to standard form gives

\[\begin{split}\begin{aligned}

\mathcal{P} \quad -\text{maximize} \quad

-x_0 - s_0 x_1 - \sum_{j = 2}^n p_j x_j &\\

\text{subject to} \quad

-x_0 - s_1(i) x_1 - \sum_{j = 2}^n h_j(s_1(i)) x_j &\leq -g(s_1(i))

\quad i = 1, \ldots, m.

\end{aligned}\end{split}\]

Observe that the primal only has inequality constraints with free variables \(\left\{ x_j \right\}_{j = 0}^n\). This implies that the dual consists of restricted variables and equality constraints.

\[\begin{split}\begin{aligned}

\mathcal{D} \quad \text{minimize} \quad

\sum_i -g(s_1(i)) y_i &\\

\text{subject to} \quad

\sum_i (-1) y_i &= -1\\

\sum_i -s_1(i) y_i &= -s_0\\

\sum_i -h_j(s_1(i)) y_i &= -p_j\\

y_i &\geq 0 \quad i = 1, \ldots, m

\end{aligned}

\quad \equiv \quad

\begin{aligned}

\mathcal{D} \quad -\text{maximize} \quad

\sum_i g(s_1(i)) y_i &\\

\text{subject to} \quad

\sum_i y_i &= 1\\

\sum_i s_1(i) y_i &= s_0\\

\sum_i h_j(s_1(i)) y_i &= p_j\\

y_i &\geq 0 \quad i = 1, \ldots, m.

\end{aligned}\end{split}\]